A year ago, I started saving up by investing on the fund and stock market. In this post, I will share some of my learning, strategy (or lack thereof) and results from a year of fund and stock trading. I will skip a lot of small details and instead provide a high-level overview of what I have been doing.

Disclaimer: This is not financial advice. It is purely informational. I probably don’t need to write this disclaimer since I’m not a business, but now that I’ve done it, you have no excuse to blame me if you follow the same strategy as me and lose all your money :-)

Starting out

The financial market is very overwhelming at first, because there are so many terms and weird financial instruments. To me, stocks and funds are the easiest to grasp, because they are the most intuitive. Owning a stock is like owning a small part of a company. Owning a share of a fund is like owning a small part of an investment portfolio. It thus made sense to focus on stocks and funds to begin with.

Even with a limited scope, it took many hours of reading to learn about indicators such as P/E number and sharpe ratios as well as finding tips on different strategies for investment. My bank had some excellent and digestible articles (in Swedish, sorry) that were very helpful.

The first basic conclusion from this research was this: when investing, spread the risk. This is colloquially known as “don’t put all your eggs in one basket”. There are different ways of spreading the risk, and I decided to follow three common suggestions:

- Invest at regular intervals over time instead of irregular one-time payments. This ensures that investments are made during both economic ups and downs.

- Invest in multiple regional markets (e.g. North America, Europe, Asia). Trouble in one market might be offset by an economic boom in another.

- Invest mostly in funds. Funds generally have at least 50+ stocks in their portfolio which is good for spreading risk over many companies.

I also wanted to get my feet wet trading stocks, so I decided to divide my monthly savings with 80% for buying funds and 20% for stocks. That has been a bad idea so far, but I will get back to that later.

Finding the right fund

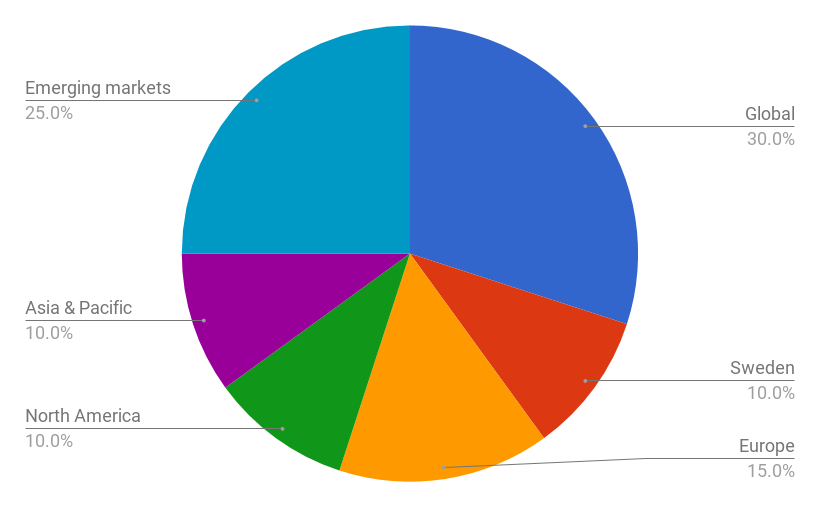

Learning about fund trading is one thing, actually starting to buy them is another. The first task was to figure out the regional composition of the funds. Reading various blog posts and using my bank’s automatic fund portfolio generator, I got an overall idea of what the composition could look like. I ended up with this distribution:

A few notes on the chosen distribution (and perhaps specific for my situation):

- It might seem curious why I put 10% in Sweden, but this is simply because I live here :) Interestingly, the portfolio generator from the bank suggested investing a full 25% in Sweden. I decided this was too much, but 10% is still a pretty big chunk for a single country.

- “Emerging Markets” is a blanket term that actually often covers multiple regions, for example China and Brazil.

- Asia/Pacific funds often mostly exclude Japan which has its own category of funds.

With the regional composition figured out, the next step was deciding what specific funds to invest in. This was not as easy.

Passive vs Active Funds — a brief digression

Feel free to skip this section if you know what active and passive portfolio management is and/or if you are not interested in listening to me rant about it. I included extra information on this topic, because I think it is important and interesting. There will be a conspiracy theory as well.

It is useful to mention the two primary portfolio management styles for the funds I’m interested in: active vs passive. The distinction was very confusing to me at first, so it might be helpful to first re-iterate what they mean:

- Passively managed funds are also known as index funds. They follow a specific market index (e.g. S&P 500, MSCI World Index), and their stock portfolio is a more-or-less direct reflection of that index.

- Actively managed funds have investors that make active decisions (hence the name) on what to buy and sell with the goal of out-performing “the rest of the market”. This is a little vague, but it often means that they try to beat a specific index or simply “outperform the market”.

I think “passive” is a bit of a misnomer. From my perspective, “passive” means something that just “takes care of itself” and that is not the case of passive funds. Most of them are still managed by an actual human that buys and sells the stocks in the fund’s portfolio.

Besides the management style, the most important distinction between a passive and an active fund is the management fee. Passive funds are usually much cheaper than active funds. The management fee for a typical passive index fund on my trading platform ranges from 0.2%-0.5% while active funds range from 1%-2%.

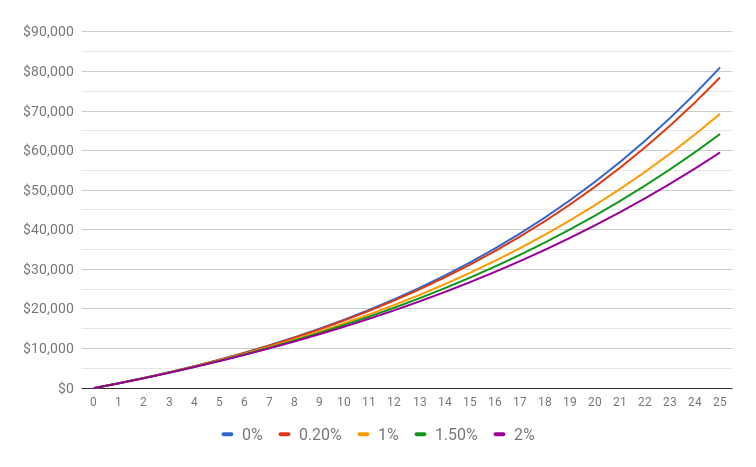

This difference does not sound like a lot until it is visualized on a graph, so allow me to do that now. Assume you save $100 per month over 25 years, i.e. the total investment is $30,000. Assume also that you have a 7% rate of return each year. The graph below shows the value of the investment over time for different management fees.

The result is quite interesting. Without any fees, the $30,000 investment ends up at about $81,007 (a 170% increase). That’s pretty good, but probably unrealistic since most funds have at least a small fee. With a cheap fund (0.2% fee), the money would have reached $78,490. Still pretty good! With a more expensive fund (1% fee), the money would have reached $69,299.

Think about this for a second. With just 1% in fees, the total outcome is 12% lower ($9,191) than if the fee had been just 0.2%. For a fund with 2% in fees, the outcome is a whooping 24% lower. The reason for this is that fees are double-bad. Not only do they dig into the investment each year, but that lost capital is also lost potential for future investment. So the effect is much worse over time as seen on the graph.

At this point, it is relevant to ask the big question: do active funds have higher rate of return than passive funds?. This is literally a million-dollar question, and I don’t know the answer. I can appeal to your intuition and share some articles though.

First, how well should an active fund perform for it to be a better choice than an index fund? In rough numbers, a fund with a 1.5% fee needs to be 1.3 percent-points better than an index fund with a 0.2% fee. Let’s say the index fund has a rate of return of 7% like in the example above. The active fund thus needs to have a rate of return of 8.3% just to break even with the index fund.

Here is a follow-up question: do you think it is possible for an active fund to outperform the market for 25 years straight? Of course not, it is just not possible. Or at least: it is not mathematically possible for all active funds to do this.

Don’t take my word for it though. Here are a few articles that I found: Almost no one can beat the market, Mission Impossible: Beating the Market Forever, How Many Mutual Funds Routinely Rout the Market: Zero.

The only people that say it is possible to beat the market are the fund managers. And for good reason. If a billion-dollar fund takes out a 2% fee, that is a very hefty salary for potentially only a handful of managers. In fact, it is a salary so overwhelmingly high that it becomes very difficult to trust that they always have their investors’ best interest in mind.

This is actually my biggest issue with active funds, and I admit it is ideological and not necessarily rational. I hate the thought of some rich manager investing my money with absolutely no risk for themselves. If a manager under-performs, they might lose their job, but I lose all my money. If I invest in an index fund and the market crashes, I cannot really blame the market.

This section has already gotten a bit out of hand, but I think I promised a conspiracy theory at the beginning of this section so let me end with that: could the term “passive fund” be cooked up by the financial elite to make it sound less attractive? We are often told to have active lifestyles, make active choices in life, participate actively in our community etc. It is very rare that “passive” is a good thing. So when choosing a fund to invest in, we might subconsciously be turned off by “passive” funds. Think about it. It all makes sense! :-)

Low cost funds for the win

It should be clear by now that I have a preference towards passive index funds. However, that is not to say that active and passive funds cannot coexist. There are a few fairly cheap active funds out there, so when I finally had to actually choose funds for my portfolio, I decided to take a somewhat mixed approach based on the following rules of thumb:

- Keep fees as low as possible, preferably below 1%.

- Invest in about two funds per region. At least one passive and possibly one active.

- Only consider funds with a sustainability profile/statement.

- Look at past performance, sharpe-ratio and Morningstar rating but do not get hung up on it.

I ended up with 12 funds initially last year, and have changed out two funds and added another, so I now invest in 11 funds monthly, but I still have 13 funds in the portfolio. I could share the entire portfolio at this point, but I could not find any good tools for sharing a Swedish fund portfolio (besides typing them out in Excel), and the information will not really be helpful for anyone living outside Sweden anyway.

Here are some numbers though…

- The average management fee for my portfolio is 0.47%. The lowest fees is 0% and highest is 1.8% (I recently changed this for my monthly transfer). Without the most expensive fund, the average fee is 0.35%.

- The investment has grown between 6% and 10%. The number varies quite a lot during any given month.

- The highest growth for a single fund is 14.4% and is a fund for the Emerging Markets region.

- The lowest growth for a single fund is 6.3% and is a fund for the North America region.

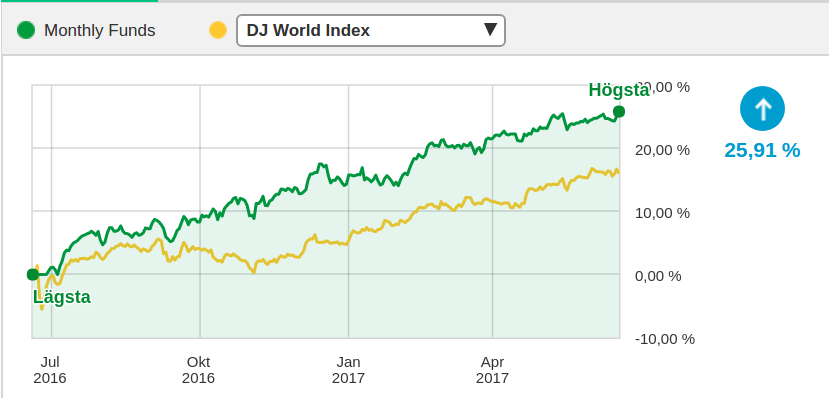

A note on growth: The numbers I quote above are the actual growth in terms of how much extra money I would get if I sold all funds right now. The growth of the portfolio in terms of the market itself is calculated by my bank to be 25.9% in one year. Honestly, I don’t understand how this number is calculated, but it looks pretty on a graph when compared to the Dow Jones World Index:

Hopefully, my fund portfolio will continue to grow steadily. Anything above 5% is a win for me, so I am currently very happy with how it is going.

Not a stock trader

While my funds have done well, my stocks have not. I currently have a few shares in 19 different companies. My buying strategy has been a bit random, and I have tried out different approaches to trading stocks. Here are a few highlights:

- The Cash Dividends. Many big companies pay dividends. This sounded fun, so I bought some stock in a few boring, stable companies like Nordea (a bank), Telia (a phone/telecommunication company) and Knowit (an IT consultancy). I got my first payouts a few months ago, and actually, it was fun to get extra pizza money during the early months of the year! Besides the dividends, the stock prices of these companies are also the most stable with the exception of Knowit that has increased 124% in one year and is pretty much the only reason why my portfolio is not showing red numbers (yet).

- The Stock Emissions. When companies want extra money for whatever reason (e.g. more research, new investments or paying off loans), they will often emit new stock. I participated in one of these emissions for a company called BrainCool that produces and sells equipment for medicinal cooling of the brain. So far, the stock has not been very cool though. The value of my stock is down 48% as of this writing.

- The IPO. I participated in the initial public offering (IPO) for a company called Isofol Medical that produces a drug used during colorectal cancer treatment that potentially works better than existing drugs. The value of the stock fell immediately after the IPO and my stock is now down 20% so it was also not a good investment.

- The company in trouble. I purchased stock in Eltel without realizing the company was in an obviously bad shape. I basically just looked at their (previously) fairly generous dividend payouts, and failed to pay attention to the numerous scandals and trouble the company was going through. Because of their problems, they decided to not pay any dividends to investors this year. But not only that, the stock price itself has dropped 51% since I bought it.

Overall, my stock portfolio has increased 0.21% in value and that includes cash dividends. Let’s round that to 0%, and the only redeeming factor is that at least I did not lose any money (yet).

The last story in the list above is the best example of my incompetence as a stock trader, and why I should probably just stick to funds. After all, I will always be an amateur trader, and I just do not have the time and skills to really analyze the market and make informed decisions about my stock purchases.

The path forward

A year ago, I started at $0 and grew my portfolios slowly using a monthly money transfer. As you can imagine, this means my total investment is still quite small. This also explains why I have been willing to take some risks and experiment a bit with stock trading. Losses suck, but they are not catastrophic when the investment is small. However, as my savings keep growing, there is more at stake. My investments are probably going to be a significant portion of my future pension, so having a fairly stable growth using funds is probably better than trying my luck with stock trading, although the yields are potentially much higher.

I have not fully decided whether to give up on stock trading completely though, because there is a certain allure to the idea of owning a part of many companies directly as well as the dream of the 5,000% stock increase.

How to shape the path forward is still an open question for me. Writing this post has helped gather my thoughts on the subject, but I have not concluded anything yet so I will probably keep doing what I am doing. Money decisions are always difficult :-)